Leverage simply means the % amount of money you are allowed to borrow from the broker when you open a position.

Typically in Stock market when you buy 100 shares of a company trading at $10 per share, you are required $1000 to open the trade. Some stock brokers would let you borrow money from them, most cases it is 50-80% of the total stock value.

So instead of $1000 you are now only required to have $500. This helps traders to buy more shares with same amount of money. However stock broker would charge you interest on the money borrowed – Forex Leverage is similar except on steroids.

How Leverage Works in the Forex Market?

A typical Forex Broker would let you borrow 99% of the total value required to open a trade and you only need to come up with the remaining 1%.

So if you are about to trade $1000 then you only need to have $10. Big difference from normal stock trading. Also Forex broker won’t charge you interest on the borrowed amount.

Note that in case of stock trading you will liable to pay up $500 (or more) you borrowed in case of a loss. In Forex, your broker will close out all open trades as soon as your account available balance reaches zero.

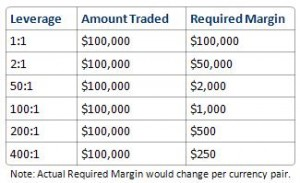

The above table is only a guide, when trading live the Required Margin will change based on currency pair. In my personal opinion one should not go beyond 100:1 leverage. However your opinion may differ so feel to add comment with your preferred leverage and why.

If You Want to Become a Successful Forex Trader, You Must Join AndyW Club.